U.S. stocks are seen moving into the red on Monday, extending losses made on Friday and a weak handover from global shares, as investors mull over the potential for further central bank aggressiveness and whether these policies could trigger a widespread economic slowdown.

At 07:01 ET (11:01 GMT), the Dow Futures contract was down by 61 points, or 0.21%, S&P 500 Futures traded 12 points, or 0.33%, lower and Nasdaq 100 Futures fell just over 51 points, or 0.46%.

The main equity indices on Wall Street slumped to close out trading last week, with the blue-chip Dow Jones Industrial Average losing 630 points, or 2.11%, the broad-based S&P 500 dropping 2.80% and the tech-heavy Nasdaq Composite shedding 3.80%.

Weighing on sentiment was a stronger-than-expected labor market report in the U.S. on Friday, which helped to reinforce expectations that the Federal Reserve will continue to hike interest rates in a bid to quell soaring inflation, but potentially at the expense of wider economic activity and corporate incomes.

The concerns carried over into Monday dealmaking in Europe, where the Stoxx 600 index touched a six-month low.

Shares in Asia also fell sharply, although trading volumes were muted due to holidays in Japan and South Korea.

The blue-chip Shanghai Shenzhen CSI 300 index sank 2.21%, while the Shanghai Composite index shed 1.66%. Chipmakers, including Anji Microelectronics Tech Co Ltd (SS:688019) and Chengdu Xuguang Electronics Co Ltd (SS:600353), were among the biggest laggards, plummeting as much as 20% after the White House unveiled export controls, cutting off Chinese companies from certain semiconductor materials made with U.S. equipment.

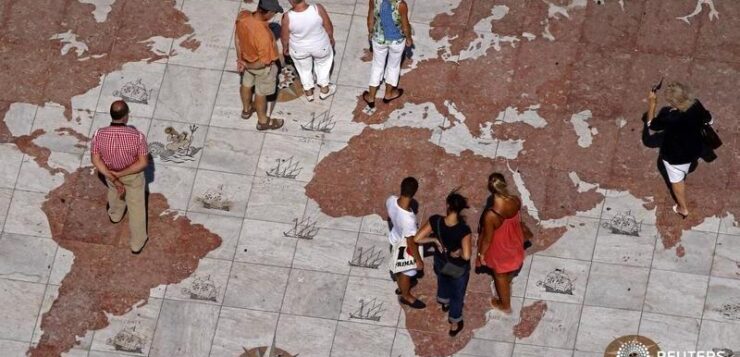

The U.S. move threatens to worsen trade ties between the two largest economies in the world, and could have deeper economic implications if China retaliates.